Mutual Funds

Aditya Birla SL Gold Fund(IDCW)

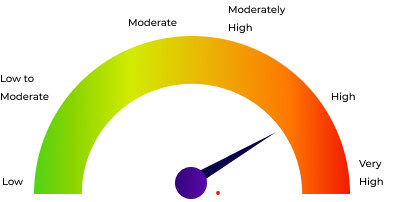

Commodity | High | FoFs (Domestic / Overseas ) - Gold |

28.43

-0.13 NAV(₹) as on 6/6/2025 |

-0.45% 1D |

31.18% 1Y |

21.98% 3Y |

14.34% 5Y |