Mutual Funds

Aditya Birla SL G-Sec Fund(G)-Instant Gain

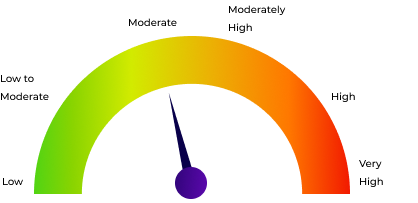

Debt | Moderate | Debt - Gilt Fund |

79.84

-0.62 NAV(₹) as on 6/2/2026 |

-0.78% 1D |

0.98% 1Y |

5.69% 3Y |

4.89% 5Y |