Mutual Funds

Aditya Birla SL Debt Plus Arbitrage FOF-Reg(IDCW Payout)

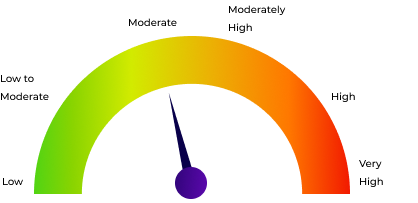

Other | Moderate | FoFs (Domestic) - Debt Oriented |

23.53

+0.02 NAV(₹) as on 30/6/2025 |

0.07% 1D |

8.72% 1Y |

7.44% 3Y |

6.14% 5Y |