Mutual Funds

Aditya Birla SL Dynamic Bond Fund-Reg(G)

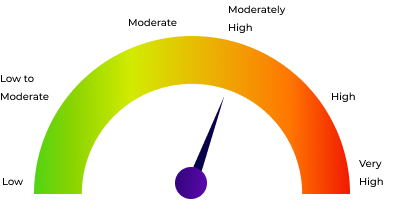

Debt | Moderately High | Debt - Dynamic Bond |

47.31

-0.15 NAV(₹) as on 6/2/2026 |

-0.32% 1D |

5.88% 1Y |

7.28% 3Y |

6.78% 5Y |