Mutual Funds

Sundaram Arbitrage Fund(G)

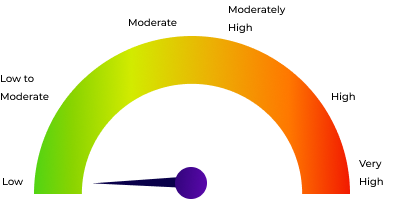

Hybrid | Low | Hybrid - Arbitrage Fund |

14.71

+0.01 NAV(₹) as on 4/11/2025 |

0.08% 1D |

6.19% 1Y |

6.74% 3Y |

5.06% 5Y |