Mutual Funds

WOC Liquid Fund-Reg(W-IDCW)

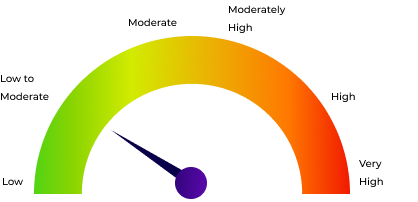

Debt | Low to Moderate | Debt - Liquid Fund |

1,002.38

+0.44 NAV(₹) as on 6/6/2025 |

0.04% 1D |

7.17% 1Y |

6.79% 3Y |

5.25% 5Y |