Mutual Funds

Axis CRISIL-IBX Financial Services 3-6 Months Debt Index Fund-Reg(G)

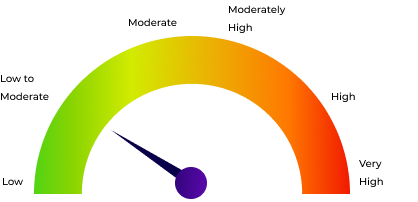

Debt | Low to Moderate | Debt - Index Fund |

10.12

+0.00 NAV(₹) as on 4/12/2025 |

0.01% 1D |

- 1Y |

- 3Y |

- 5Y |