Mutual Funds

SBI LT Advantage Fund-III-Reg(G)

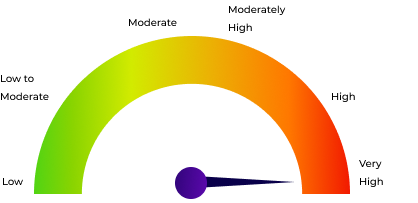

Equity | Very High | Equity - ELSS |

42.92

-0.25 NAV(₹) as on 4/11/2025 |

-0.58% 1D |

-5.54% 1Y |

14.51% 3Y |

23.41% 5Y |