Mutual Funds

HDFC Nifty 1D Rate Liquid ETF(G)

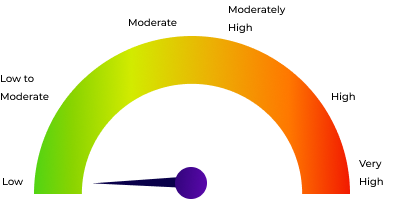

Debt | Low | ETFs - Debt |

1,047.52

+0.22 NAV(₹) as on 8/2/2026 |

0.02% 1D |

5.07% 1Y |

- 3Y |

- 5Y |