Mutual Funds

Baroda BNP Paribas NIFTY SDL Dec 2028 Index Fund-Reg(G)

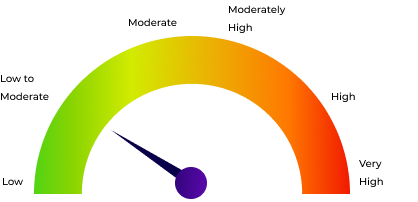

Debt | Low to Moderate | Debt - Index Fund |

12.43

+0.00 NAV(₹) as on 2/2/2026 |

0.01% 1D |

7.28% 1Y |

- 3Y |

- 5Y |