Mutual Funds

SBI Credit Risk Fund-Reg(G)

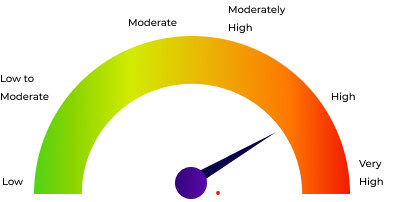

Debt | High | Debt - Credit Risk Fund |

46.79

+0.03 NAV(₹) as on 6/11/2025 |

0.07% 1D |

8.45% 1Y |

8.23% 3Y |

6.78% 5Y |