Mutual Funds

HSBC Credit Risk Fund-Reg(G)

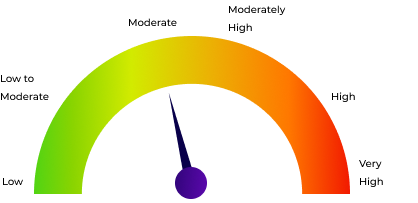

Debt | Moderate | Debt - Credit Risk Fund |

28.73

+0.02 NAV(₹) as on 17/4/2025 |

0.08% 1D |

9.51% 1Y |

6.85% 3Y |

6.22% 5Y |